Don’t Just Aim to Create Wealth. Aim to Become a Smart Investor — Change Your Identity First.

Every seasoned investor started somewhere. The key is consistency.

When most people enter the stock market, their first goal is simple — to make money. Some dream of doubling their investments, others imagine themselves becoming billionaires. That’s fine. Having an outcome-based goal is natural. But if that’s all you're chasing, you may never build the mindset required to actually reach that goal. The real secret lies not in chasing wealth — but in becoming the kind of person who attracts and grows wealth consistently.

This is about identity transformation — from someone who “invests to get rich” to someone who “is a smart, seasoned investor.” One is outcome-driven. The other is process- and identity-driven — and that’s where long-term success is born.

🧠 Why Identity Trumps Outcomes

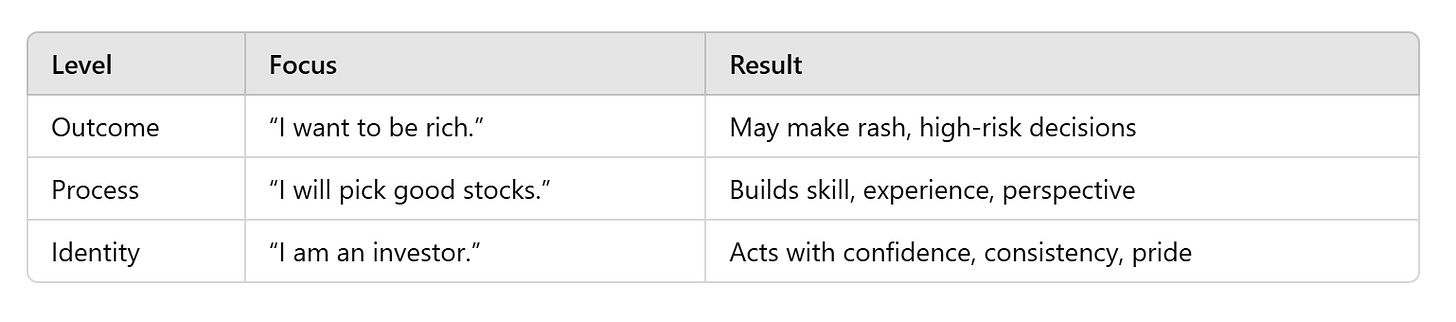

Let’s understand this with a layered model of change:

Outcome: What you want — becoming a billionaire, retiring early, buying a house, etc.

Process: What you do — analyzing businesses, studying macro trends, managing risk, reviewing portfolios.

Identity: Who you believe you are — an investor, a learner, a disciplined capital allocator.

Most people start with outcomes. But the most profound and lasting changes — the kind that actually lead to success — start with identity.

If you keep thinking “I want to become rich,” your motivation will rise and fall with market cycles.

But if you shift your mindset to “I am a smart, long-term investor,” then your habits, thinking, and discipline start aligning naturally.

🔁 The Cycle of Identity-Driven Investing

When you start believing you're an investor — not just someone trying to invest — your behaviors change. You’ll start:

Spending more time reading annual reports instead of news headlines.

Valuing business quality over temporary price dips.

Talking about capital allocation and risk management, not just stock tips.

Feeling proud of patience, not impulsiveness.

And slowly, as these actions repeat, your identity becomes stronger. And here’s the most powerful part:

Once your pride gets involved, you will fight tooth and nail to maintain your habits.

This is where the magic begins.

🏗️ Identity Fuels Discipline

Why do people who call themselves "runners" wake up at 5 am even when it’s raining? Why do vegetarians resist non-veg food at weddings without a second thought?

Because they don’t think it’s a choice anymore — it’s who they are.

The same is true for smart investors. Once you believe you are a disciplined investor, you won’t chase penny stocks or momentum just because your friend gave you a hot tip. You’ll wait. You’ll analyze. You’ll follow your framework. Because breaking those habits would mean breaking your own self-image.

And that’s something no human likes to do.

📊 Process > Outcome

If your only goal is to become a billionaire, your mood and decisions will be constantly swayed by the market. But if your focus is on the process — reading, analyzing, learning, reviewing, thinking long-term — you’ll keep growing even during corrections and bear markets.

Because in the market, you can’t control outcomes, but you can always control your process.

And your process gets refined when your identity is solid.

Think of it like this:

⚔️ The Power of Ego (When Used Wisely)

Now comes the twist — ego is not always bad.

Once you start identifying as a smart investor — someone who is disciplined, patient, and research-driven — your ego will actually protect your process. You’ll feel uncomfortable acting against your own identity. That discomfort helps you stay the course.

Ego becomes your invisible guardian — not to impress others, but to stay loyal to your core values.

That’s why seasoned investors don’t easily jump on fads, don’t panic in crashes, and don’t boast about short-term gains. Their pride is not in the outcome — but in the process and discipline they’ve cultivated over years.

They are no longer just chasing wealth. They are protecting who they are.

🧱 What Does a Smart Investor Identity Look Like?

Let’s break it down into 3 parts:

1. Stock Picking Skill

Deep understanding of business models

Reading between the lines of financials

Knowing what to avoid

Tracking sectoral trends

Understanding competitive advantage

2. Capital Allocation

Not putting all eggs in one basket

Balancing risk vs reward

Parking dry powder for opportunities

Knowing when to exit

Keeping emotions in check

3. Patience + Courage for Long Game

Holding through volatility

Not comparing with others

Staying invested in conviction bets

Ignoring noise

Thinking in decades, not quarters

These are not tactics. These are habits rooted in identity. Once you take pride in being this kind of investor, your decisions will automatically reflect it.

🚀 Final Thought: Don’t Just Grow Your Portfolio. Grow Into It.

Anyone can get lucky in the market once. But to consistently create wealth, you need more than luck. You need a mindset. A process. A set of principles. And most importantly — an identity.

Don’t just aim to become a crorepati or billionaire. Aim to become the kind of investor who deserves to manage crores and billions.

The outcome is what you get.

The process is what you do.

The identity is who you become.

And when you become a true investor in your mind and soul — the wealth, the respect, the confidence — all follow naturally.

Because now, your pride is involved. And you will protect that identity with everything you’ve got.

~ Sanjay