It's not a “Time to be cautious” rather “Time to start bottom fishing”. Risk is high when stocks trades at ATH, now we are in a low risk zone.

To make money in stocks, you need to have vision to see them, courage to buy them and patience to hold them. Patience is the rarest of the three. ~ Thomas Phelps

“Once in a decade there will be a major bad event (like 2000 IT bust; 2008 - Financial crisis; 2020 -Pandemic crash) it depends on YOU, how aggressively you acted during the bad event. Except this nothing else matters in stock investment. It means be an aggressive investor in the market when there is a bad event and be conservative when things are good.” After 2022, a dull period, we are in 2023 and this is the time to go aggressive.

Two weeks back, I received one email from one of the popular financial website with heading “Time to be cautious”. These were the highlights from their commentary…

A record short selling build-up in the derivatives segment by foreign portfolio investors.

The recent chain of events led by the Adani-Hindenburg issue, George Soros’s speech and Putin’s speech have all increased downside pressure on the markets.

Reports say the average cash holding of the top 20 mutual fund houses by Asset Under Management (AUM) was at a 25-month high of 5.9 percent.

After a strong budget, markets have been rattled by the Adani issue and have failed to recover from it. Add to that a lower-than-expected earnings season which has kept the Indian market valuation high.

The one-year forward price-earnings (P/E) multiple of the Nifty 50 Index is 18, nearly 10 percent higher than the 10-year average P/E multiple of the index.

Indian markets are trading at a 25 percent premium to other emerging markets compared to a historical premium of 15 percent.

More than 500 stocks have fallen by 50 percent in the past two years while another 500 are down by 30 percent. But for a few index heavyweights, most of the market is in a bear market.

Global markets are also showing signs of fatigue. The US markets on Tuesday posted their biggest fall in 2023 on the back of a strong flash PMI reading, which could force the Fed and other central banks in the advanced economies to hold interest rates higher for longer.

According to a SEBI report, active traders have increased by 500 percent since 2019, but only one in 10 is profitable and less than one percent was able to beat FD rates.

Looking at the cautious positions of mutual fund managers, short build-up by traders, growing tension between the US and Russia and the falling global markets, it is better to tread carefully.

Now, if someone reads above warnings, he/she will either sell his portfolio or stay away from the market. If you notice, market has shown swift recovery during last 2 weeks too. In general bad news or panic commentary comes at the bottom when damage is already done and there is no reason to withdraw.

Warren Buffett once said that it is wise for investors to be “fearful when others are greedy, and greedy when others are fearful.”

An Investor’s Biggest Edge

An investor who can hold on in the face of all of the advice and temptation to ensure a profit by selling an existing position demonstrate quality of mind quite out of the ordinary.

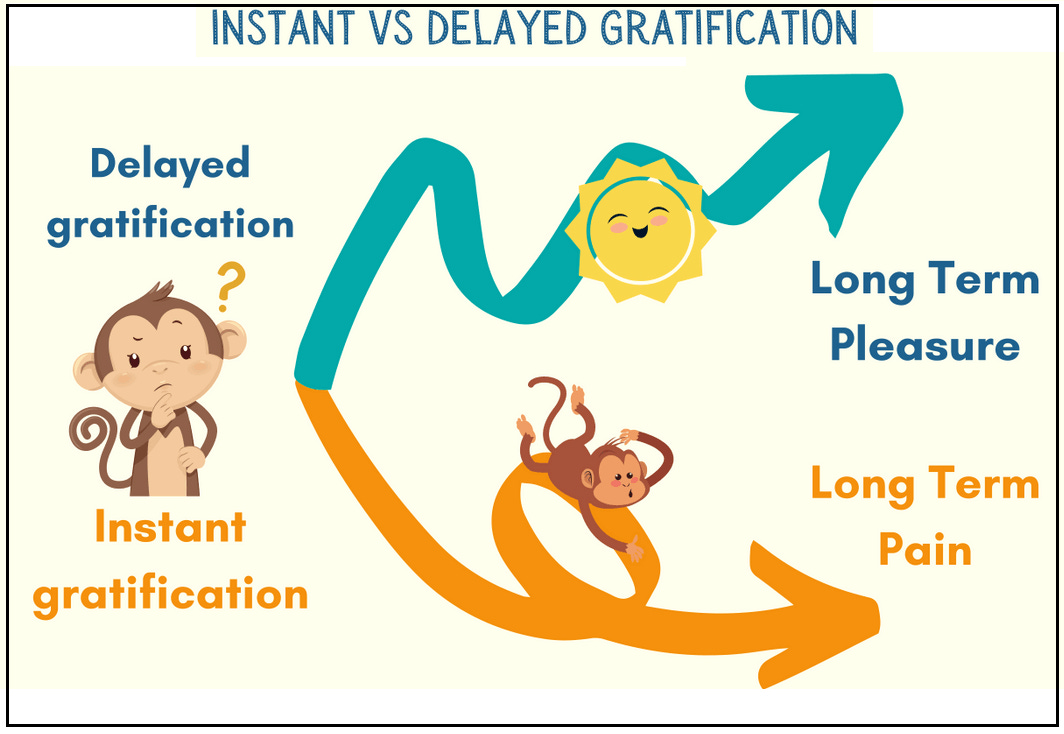

Embracing deferred gratification is what lead to the single biggest edge for an investor. Human nature makes it difficult to utilize this edge. This difficulty is the very reason the edge exist and because human nature will never change, this edge is a durable one for those who posses the right temperament to capitalize on it.

If everything you do needed to work on a 3 years time horizon, then you are competing against a lot of people. But if you are willing to invest on a 5-7 years time horizon, you are now competing against fraction of those people, because very few people are willing to do that. Just by lengthening the time horizon, you can engage in endeavor that you could never otherwise pursue.

The ability to have a long term orientation is now a biggest advantage than ever before. 50 years ago the average holding period for stock was 7 year. Today it is barely 4 months. The short term mind set that is all pervasive in the market creates irrational buying and selling for all the reason that have everything to do the short term direction of the stock but nothing to do with the long term value of the business. Because the financial community has an ever-increasing focus on the next quarter, a long term orientation is a structural competitive advantage for an investor.

Most talent on street are focused on competing in the short term, next few quarters, this leads to a big opportunity for those who can look 3-5 years out & quietly consider the big picture.

Capitalizing on other's desire to avoid volatility is what makes this strategy work.

Clients tend to demand constant success and have little patience for short term underperformance, and this means that fund managers risk losing both AUM and their jobs if they do not intensely focus on the next month, quarter or perhaps year at the most.

Dealing with this interim volatility is the price of admission, but it is one that few market participants are willing to pay, and that is precisely why having a patient mind-set, focusing on long-term CAGR instead of yearly returns, and embracing volatility leads to significant financial rewards. This is time arbitrage in action.

Happy Investing!

-Sanjay